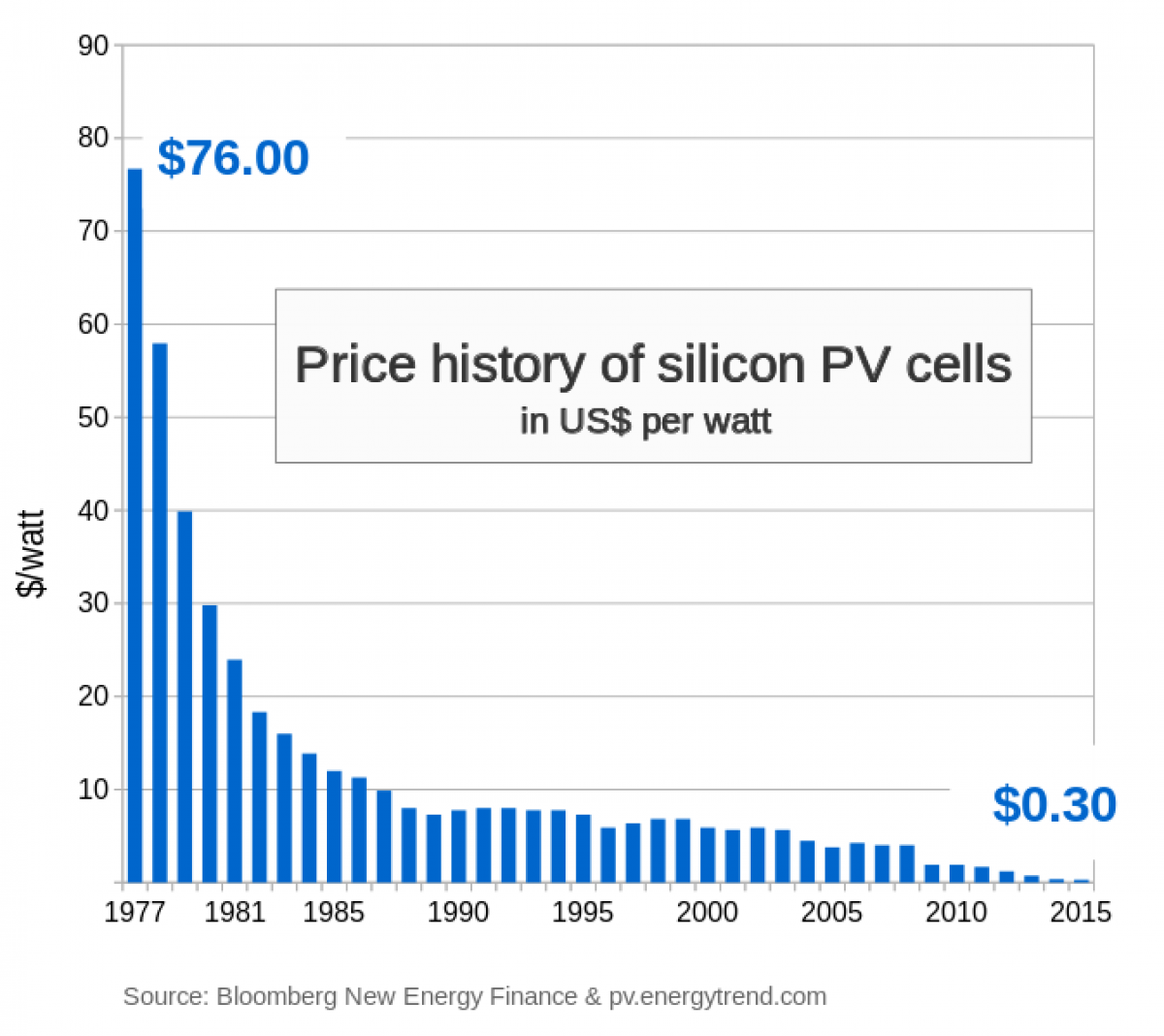

Moore’s Law might be dead, but Swanson’s Law remains alive and well.

Swanson’s Law is the observation that solar PV panels tend to become 20 percent cheaper for every doubling of cumulative shipped volume. It’s the solar industry’s equivalent of Moore’s Law, which predicts the growing computing power of processors. But as the semiconductor industry has discovered, the observation that processing power increases exponentially at a two-year or so cadence has hit a physical limit.

Fortunately, Swanson’s Law is yet to come up against such a brick wall, and solar energy costs have continued to come down precipitously for decades--without exception. And now the renewable energy industry is about to cross a major milestone that will truly set it on the path towards becoming the world’s predominant energy source.

According to a report by the International Renewable Energy Agency (IRENA) cited by Reuters, beginning in 2020, electricity generated by solar PV and onshore wind is set to become consistently cheaper than the most cost-effective fossil fuel alternative, without subsidies.

In essence, more than 80 percent of solar PV and 75 percent of onshore wind power deployments to be commissioned next year will be cheaper than the cheapest new oil, natural gas, or coal-fired sources as per the report. Related: Norwegian Oil Patch Ramps Up Spending To Counter Decline

This report has a pretty wide scope, having been compiled from IRENA’s own members, governments, consultancies, industry groups, business journals, auctions, and tenders. IRENA’s membership includes research institutes, project developers, utilities, and power companies across 160 countries, all of which contribute data for its Renewable Cost Database.

Swanson’s Law in Action

According to the IRENA report, the global weighted average cost of power generated using solar energy fell another 26 percent last year compared to the previous year. Bioenergy costs declined 14 percent, solar PV and onshore fell 13 percent, hydropower was 12 percent lower, while offshore wind was 1 percent cheaper last year. Costs of as low as $0.03-$0.04 per kilowatt hour (kWh) for solar PV and onshore wind have already become a reality in some parts of the globe.

IRENA estimates that the global average cost of electricity for solar PV will clock in at $0.055/kWh in 2020, then fall another 13 percent to $0.048/kWh in 2021. As for onshore wind, corresponding estimates are $0.049/kWh and $0.045/kWh in 2020 and 2021, respectively.

Road to 100% renewable energy

At the turn of the century, the idea that renewable energy could become a major source of energy during our lifetimes would have sounded incredible, even preposterous. After all, fossil fuels were just too dominant and much cheaper, while renewable energy faced seemingly insurmountable technical, cost, and integration challenges.

Yet the impossible could be about to happen.

Over the past decade, renewable energy has experienced transformative changes, enabling it to play a very significant role in our energy industry. The solar industry has in particular been a standout performer thanks to remarkable price declines by solar PVs and increasing grid flexibility.

According to data by the Solar Energy Industries Association (SEIA), U.S.’ cumulative operating solar PV capacity stood at 62.4 GW by the end of 2018--about 75 times the installed capacity just a decade ago-- supplying 1 percent of the country’s electricity needs. Related: The Second Machine Age Could Crash Oil Prices

The future of renewable energy is looking brighter than ever. Energy company BP has projected that solar and other renewables will supply 30 percent of the world’s electricity needs by 2040 and up to 50 percent in regions such as Europe. That’s an upgrade from the firm’s last year forecast of 25 percent by 2040.

BP estimates that renewables will only take 25 years to go from 1 percent to 10 percent of global energy compared to 45 years for oil and more than 50 years for gas. The funny thing is, growth of solar has been consistently underestimated over the past decade, with actual installations outstripping projections. This means there’s a fair chance that even the most optimistic current projections might still fall short of reality a decade or two from now.

The repercussions for the global economy are bound to be enormous. Other than the potential to stop climate change in its tracks, renewable energy will likely negate at least some of the nearly $300 billion in annual energy subsidies provided by the world’s governments.

By Alex Kimani for Oilprice.com

More Top Reads From Oilprice.com:

- The Single Biggest Challenge For The Oil & Gas Industry

- Why Bears Will Win The Oil Price War

- Falling Russian Crude Output Lifts Brent Oil Prices

Nuclear is the way to go.

Second, is that renewables cannot possibly become the dominant energy source at the current pace and cannot for at least 30 or 40 years replace other so-called "non-renewables" due to the fact that there simply isn't capacity.

And to Ted Hu, "there's plenty of space". Where? I'd prefer the best areas for solar development in the U.S., namely the southwest not be covered by solar panels and wind farms. These devices are responsible for massive devastation of ecosystems and wildlife habitat already. Moreover, we have 365 wind turbines sitting on the door step of one of our projects. What used to be "dark skies" at night and wide open spaces are now filled with blinking aircraft warning lights and piles of dead golden eagles, not to mention view shed pollution in the day time. Nope, no thank you.

The other question that arises is what of the pollution derived from solar cell manufacture and disposal of obsolete or worn-out systems. Everything has an environmental footprint. Think about it.